By Rob Sisson, Rotaract delegate to COP28

Rob Sisson speaking about tipping points at Rotary’s Green Zone pavilion during COP 28

For the first time in history, humans are including sustainability information in financial decisions.

I cannot stress enough how amazing this is.

The International Financial Reporting Standards (IFRS) Foundation currently sets the international accounting standards which are mandatory for public companies in over 140 countries. In other words, this is the common language companies and investors use to compare the financial health of businesses across the world.

Pretty cool, if you’re a number nerd and like to pour over financial statements. Not that I know anyone who’s like that…

This same group, the IFRS, have recently announced the International Sustainability Standards, which will run in parallel to the accounting standards.

That means companies will disclose sustainability information next to their financial information.

So there will be the standard cash flow, balance sheet, profit and loss, and additional information regarding things related to their sustainability – such as their scope 1, 2, & 3 greenhouse gas (GHG) emissions.

That’s exceptional.

One will be able to look at how much money a business is making, and how much it pollutes to do so.

Just you try and convince me that’s not phenomenal.

Now imagine how impactful it would be if a set of sustainability standards were adopted to the same extent as the existing accounting standards.

And it looks like that will be the case, based on a momentous commitment announced on Finance Day at COP28.

Until now, humans outsourced the responsibility of making decisions to the financial markets. If something made money, it was a good decision; if it lost it, that was bad. We simplified the world to one quantitative metric so it was easier for us to manage (as humans often do).

But that meant people did things with hidden costs, because, well, the costs were hidden. It’s quite tricky to change a decision based on information you don’t know; especially if there is a financial reward for continuing what you’re doing.

This has meant money has been flowing into things which haven’t been the best for the environment, lining the pockets of the investors and producing a standard of living which many across the world now take for granted.

Many of us have benefited, especially those in the global north.

And even if we feel we haven’t directly, we can still take on the responsibility to change.

At COP28 a massive list of investors and financial institutions announced their commitment to advancing the adoption and use of the International Sustainability Standards Board’s climate-related reporting globally.

Together these groups manage over $120 trillion.

Global GDP is $104 trillion.

Let that sink in.

Investors that control more money than global GDP are committed to embedding sustainability in their financial decisions.

“ What does this actually mean?” you ask.

Businesses with lower climate risk will attract more investment. Investors will always try to reduce their risk while maintaining their return. So if a company is very vulnerable to the impacts of climate change, maybe raw material prices could increase or supply chains could break down, then there will be more risk to that business.

That means investors will steer clear and put their money in safer options that still provide the return.

“Investors” in this case is being used in a very broad sense; it includes lenders and insurers as well as typical investors: basically, anyone who would give a business money and evaluate the risk associated with the business.

No matter where the money comes from, the ultimate consequence is the same – more work will be done in that area.

And if businesses with lower climate risk get more money, they will be more competitive. More money means more research and development. These businesses will become more competitive; the services/products will become better in function or price, which will attract more customers. More customers means economies of scale will further decrease prices.

Then – through simple competition – those who don’t reduce their sustainability risks will attract less investment, and therefore they’ll have less money for research and development. This means their offering will become comparably worse and they’ll cost more since they have lower economies of scale.

These standards will pull money away from unsustainable investments.

And unsustainable industries will fall.

“You’ve been bashing on about these standards but you haven’t actually told us about them, you banana – what even are they? What will companies have to share?’

First, the expressed aim of the standards isn’t to save the world or reduce emissions. It’s to disclose sustainability risks and opportunities that are expected to affect a business’ prospects.

Make note: sustainability opportunities are a key aspect of the disclosures which are required. Think of it like financial risks and opportunities. Both are essential.

It’s not a doom-saying standard forcing fossil fuels to immediately stop (which would lead to huge humanitarian issues since we’ve got a massive dependence on them) but rather channeling the way the market already works towards positive ends.

It’s not a destructive method which will demolish existing systems and cause conflict (some think this would be good, but think of the loss of life), but rather enabling a more sustainable allocation of resources.

Incredible.

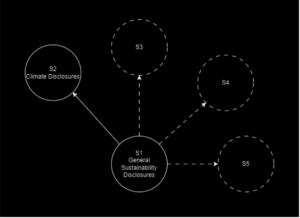

Okay, the standards: Think of it like a hub and spoke model. There are currently two standards: S1 and S2. S1 covers the general requirements for sustainability disclosures. This is the hub. Watch the overview video for S1 here. S2 covers climate-related disclosures. This is the first spoke. Watch the overview video for S2 here.

Okay, the standards: Think of it like a hub and spoke model. There are currently two standards: S1 and S2. S1 covers the general requirements for sustainability disclosures. This is the hub. Watch the overview video for S1 here. S2 covers climate-related disclosures. This is the first spoke. Watch the overview video for S2 here.

Other standards will be added to cover other areas of sustainability, which could include things such as biodiversity, BEES, human capital, and human rights (see page 16). These will be additional spokes, governed by S1.

There is still an ongoing discussion as to the priorities of the ISSB, with most stakeholders requesting additional support with implementing S1 and S2, rather than adding more spokes (quite wise if you ask me).

There are also key definitions and conceptual foundations on which the standards are based, that are largely aligned with the existing accounting standards.

So what’s next? The standards will begin to phase in throughout 2024. At COP28 the IFRS released the sustainability knowledge hub to help with implementation.

This includes guidance and implementation advice from a very large number of stakeholders, including heavy hitters such as the Association of Chartered Certified Accountants (ACCA) which is the global body for professional accountants.

The IFRS will also be hosting their Sustainability Symposium 2024 in February next year. As this area is right up my street and I find it extreeemely exciting (maybe you noticed?), I’ve created a JustGiving fundraiser to help an international Rotary delegation attend, including a Rotaract presence, as in-person tickets alone are $890 – and that’s with the early bird offer! Please consider donating.

On the sustainability standards, by all means be excited, but also realistic. It’s not smooth sailing just yet. Of course optimism is warranted when the rays of sunrise start to come over the horizon and illuminate the night, though the night is still here.

The practical implementation of these standards is immense. The number of trained professionals we will need will be huge. Think of the number of financial accountants the world currently has. We’ll probably need that many sustainability accountants in the long run as well – it’s one of the many emerging job roles which sustainability is bringing to the world.

As with any new career, learning takes time. Same with standards, they take time to phase in. This will not happen overnight: shifting the entire global financial markets towards sustainability is a mammoth. Let’s just hope this one doesn’t go extinct.

Rob Sisson is one of the 12 Rotaractors who represented Rotary International at COP 28. He is a member of Tyneside Rotaract Club in District 1030 in Great Britain, and currently works in the space where business strategy and practical sustainability overlaps, advising companies on how to reduce climate risk and channeling finance into impactful projects. He mainly focuses on tough decarbonisation problems in typically demonised industries like fossil fuels. It isn’t sexy or by any means easy, but he brings businesses to the table to collaboratively solve the issues we’re all faced with, rather than pointing fingers and pushing them away.

He also runs a startup, SeaSustain, that cleans barnacles and seaweed off ships so they use up to 10% less fuel, saving money and the planet at the same time. The challenges we’re facing at the moment are bigger than ever; but that means the opportunities for generosity are too. Overcoming the hurdles we have ahead requires previously unseen collaboration between parties that typically conflict: that’s where people like Rob come in.

With an entrepreneurial mind and a community champion’s heart, he loves navigating difficult conversations and finding an outcome that’s a win for all (including nature).

He’s run several businesses across all sorts of industries – software development, AI, biotech, education, and coaching – some small, and some with international teams and supply chains across 3 continents. After graduating with a business degree, he gained certifications from the UN in International Trade Statistics, as well as more recently completing a course in Sustainability Management.

If you’re interested in learning more about the above, or would just like a chat, reach out on LinkedIn here.